by Amar REALTOR® | June 28, 2022 3:09 am

What You Need to Know About the Spike in Mortgage Rates

Mortgage rates have reached an all-time high as the Federal Reserve’s campaign to cool inflation continues. The recent hike is just another problem for Americans already struggling with high costs of living and home purchase prices that continue climbing faster than wages can increase.

Survey of Mortgage

A recent survey of mortgage lenders discovered that the average rate on 30-year fixed mortgages has increased to 5.78%. This is the highest point since 2008 and reflects an active market with many factors, including recent Fed decisions and other economic news around town!

5.78%. This is the highest point since 2008 and reflects an active market with many factors, including recent Fed decisions and other economic news around town!

The strong economy means more Americans can qualify for mortgages and purchase homes; however, there is still some catch when considering where you live or how much income potential buyers may bring into play during their home search process. Investors are betting on more rate hikes from the Fed, leading to higher mortgage rates.

Real estate makes up a significant portion of the U.S. economy and is particularly sensitive to interest rates. Higher mortgage rates can easily add hundreds of dollars to a buyer’s monthly payments. Higher mortgage rates have the potential to affect the real estate market significantly.

Buying a home has been on an upward trend for the last two years, but it’s not due to inflation. The real reason prices are climbing is that buyers in today’s market need more money upfront than before. There aren’t as many homes being offered at low-interest rates anymore!

What does the Federal Reserve do?

What does the Federal Reserve do?

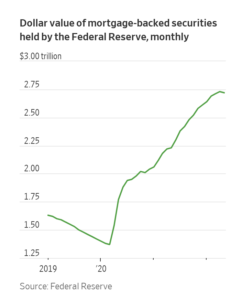

The Federal Reserve has taken an unprecedented step in response to the Covid-19 pandemic, with policies that include lowering interest rates below 0% and purchasing unlimited mortgage bonds. This action led directly to a refinancing boom as people sought higher returns on their money by investing it elsewhere; we’ve never seen anything like this before!

The mortgage rates have been upward due to the winding down of Federal Reserve purchases and rising Treasury yields. The central bank bought $13B in mortgage bonds over a month, compared with more than 100% annually earlier this year when it purchased about 35 billion dollars monthly.

Several reasons are putting pressure on each other, which causes Mortgage interest rates to increase.

The Federal Reserve has been steadily decreasing its monthly purchases of mortgage-backed securities, and this week it was announced that the program would end in less than two months. The decrease is likely due to a goal by Chairwoman Powell for “winding down” stimulus measures distributed during the last financial crisis – which could send interest rates higher if not corrected quickly enough!

The recent increase in mortgage rates worries many people, but it’s unlikely to reverse soon. Jerome Powell said at the July Fed meeting that he expects either a 0.5 or an extra quarter-point on top of existing plans, bringing them up to 2%. Lenders are offering the high-interest rates. It’s already at 6% or more and is expected to continue increasing too!

To learn more details, let’s talk with Amar REALTOR®.

Let’s schedule a meeting with Amar REALTOR to review all your Real Estate objectives at a time that works for you.

Please Click the link below to schedule a time on my online calendar!

Please Click the link below to schedule a time on my online calendar!

https://www.amarrealtor.com/meetingwithamarrealtor/

Contact Amar REALTOR® today for more information about Buying/Selling a Home in the Bay Area!

Amar REALTOR® offers expert real estate services with proven results in Bay Area Housing Market, including Homes for sale in Santa Clara County, San Mateo County, Contra Costa County, and Alameda County.

More Interesting Information about Bay-Area Real Estate

Record high: U.S. homeowners have over $27 trillion in home equity

The Difference Between Federal Funds Rate and Mortgage Interest Rate

How the Federal Reserve Affects Mortgage Rates

Mortgage Interest Rate Predictions for 2022

Should You Choose an Adjustable Rate or a Fixed Mortgage?

Source URL: https://www.amarrealtor.com/real-estate-news/spike-in-mortgage-rates/