by Amar REALTOR® | November 18, 2022 5:14 am

A History of Mortgage Rates: What Does it Mean for Home Buyers?

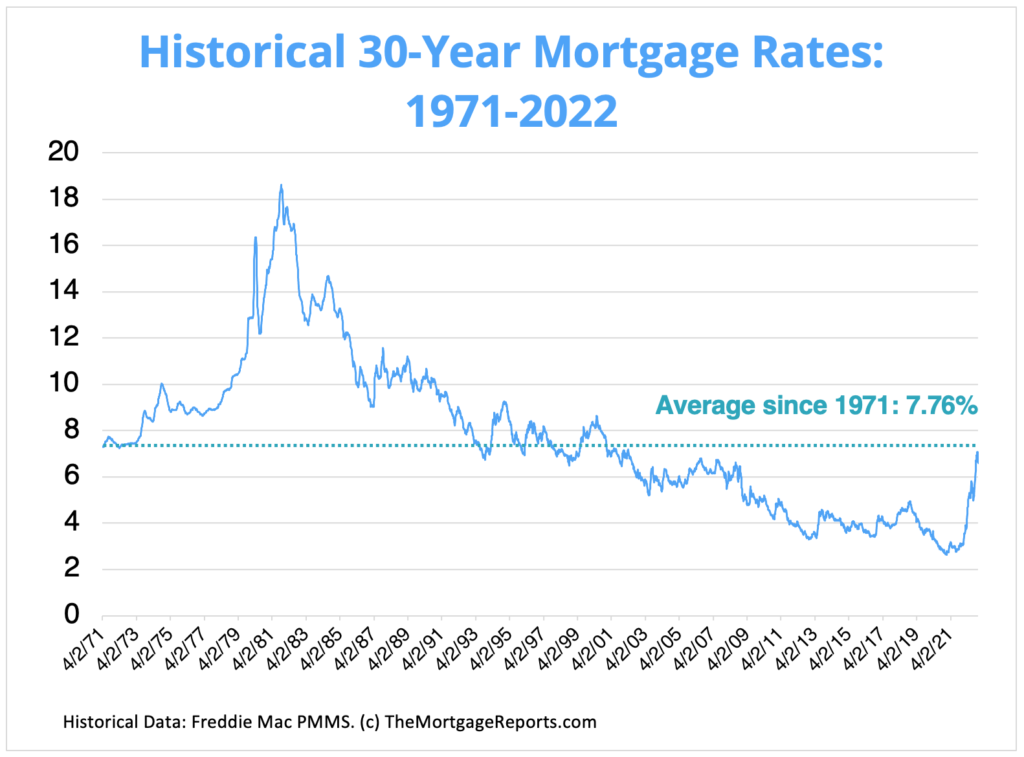

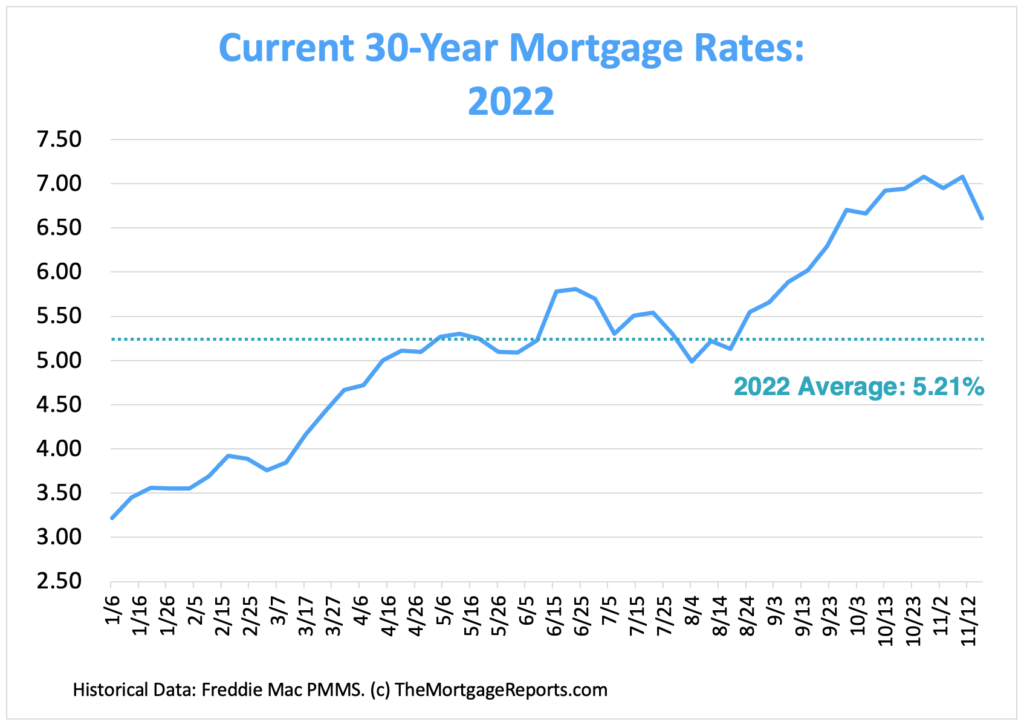

Freddie Mac has been keeping records of mortgage rates since 1971, and these records provide valuable insight into trends in the housing market. Mortgage rates have a long and varied history. 30-year mortgage rates have been as low as 2.5% and as high as 18%.

Homeownership is one of the smartest financial decisions you can make in life. Not only does it provide peace of mind and a place to live called Home, but over time it builds wealth in two ways: through appreciation and by serving as a hedge against inflation.

30/15/5-Year Fixed-Rate Mortgages Since 1971

- Mortgage rates began to climb in the late 1970s and early 1980s, peaking at an average of 18.63% in 1981.

- The Mortgage rates since 1971 have an average of 7.76%.

- Despite the recent increases in interest rates, 30-year mortgage rates are still below the Historical average of 7.76% since 1971.

Rising mortgage rates may seem like bad news for Home buyers, but it’s important to put things into perspective. Remember, interest rates are still below their historical average. Many Home Buyers or Investors are getting favorable rates with creative financing options even in today’s market.

- Interest-Only mortgage payments

- Buydowns

- Seller Financing

- 40-year Mortgage

- 5/1 or 7/1 ARM

Considering Buying a Home, you may be pleasantly surprised at how affordable Homeownership can be even with today’s higher rates. Home loans are personalized to the borrower. Many factors Affecting Mortgage Interest Rates are credit score, down payment, loan type, loan term, loan amount, and discount points.

30-Year Fixed-Rate Historic Tables HTML / ExcelXls

15-Year Fixed-Rate Historic Tables HTML / ExcelXls

5-Year Adjustable-Rate Historic Tables HTML / ExcelXls

Homeownership over Long Term

Homeownership over the long term is one of the most effective ways of wealth development for you or your family while still enjoying the benefits of Homeownership.

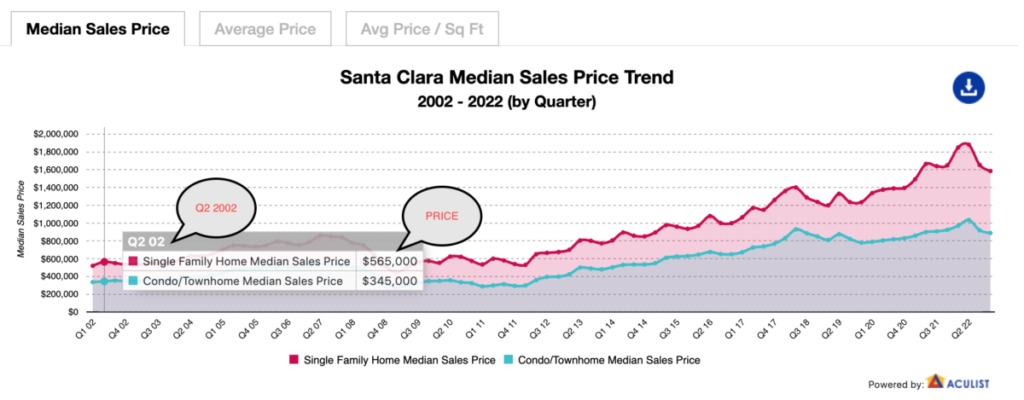

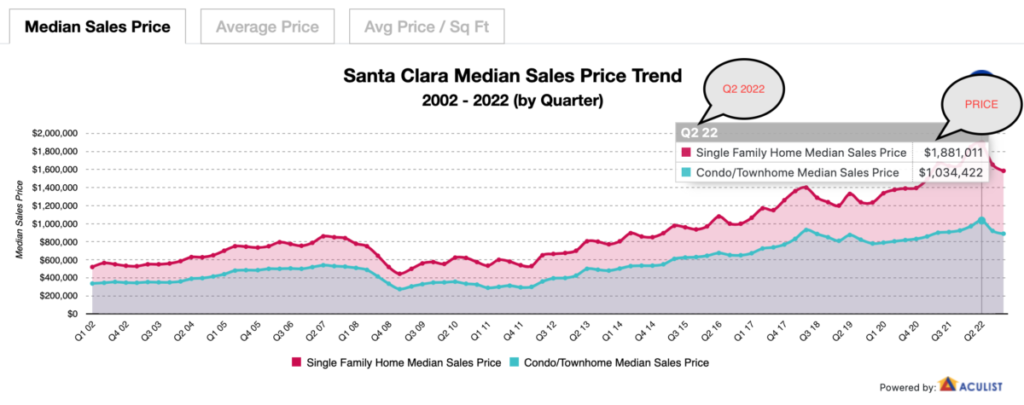

In Santa Clara County, the Single-family Home’s Median Price was $565,000 in 2002 Q2 and $1,881,011 in 2022 Q2.

We calculate the rate of return on your investment appreciation despite many ups and downs over a period.

In Santa Clara County, the Condo/Townhomes Home’s Median Price was $345,000 in 2002 Q2 and $1,034,422 in 2022 Q2.

The Interactive Housing Market data gives you Home Appreciation in various dimensions like Median Price, Average Price, and Average Price / SQ.FT. Please explore data for the year you purchased it and now.

The Return on Investment [ROI] in Homeownership is multiple times over the long term. The Home Appreciation rate is high, so your investment will increase in value over time, and Homeownership is a great way to develop wealth over the long term. Homeowners build a treasure of beautiful, priceless memories over time and are proud of Homeownership in the community instead of Renter. The pride in Homeownership is an intangible value in many dimensions.

We looked at data from various Counties in San Francisco Bay Area to see how Home prices have appreciated over time. Our findings may surprise you!

I am happy to discuss the data with you to make an informed decision.

Homeownership Hedge Against Inflation

Homeownership has always been a key part of the American dream. Not only does it provide a place to live for your family, but it’s also a great way to ensure that your money works for you. Homeownership offers numerous benefits, including building equity, creating a stable living environment for families, and investing in one’s community. Becoming a Homeowner is one of the best ways to protect your finances against inflation. As your Home appreciates, you’ll have built-up equity that can be used as a financial cushion in retirement.

Despite recent interest rate increases, making now is an attractive time to purchase a Home.

Home prices have decreased in the past few months, which is a great Home-Buying opportunity.

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful“ ― Warren Buffett

Inflation is a common worry for many people. By owning your Home, you can effectively hedge against the effects of inflation. Considering all the factors when deciding whether to buy or rent a Home is important. Remember that owning a Home is cheaper than renting over the long term.

Resources

https://www.freddiemac.com/pmms/pmms30

https://www.freddiemac.com/pmms/pmms15

https://www.freddiemac.com/pmms/pmms5

https://en.wikipedia.org/wiki/Warren_Buffett

To learn more details, let’s talk with Amar REALTOR®.

Let’s schedule a meeting with Amar REALTOR to review all your Real Estate objectives at a time that works for you.

Please Click the link below to schedule a time on my online calendar!

Please Click the link below to schedule a time on my online calendar!

https://www.amarrealtor.com/meetingwithamarrealtor/

Contact Amar REALTOR® today for more information about Buying/Selling a Home in the Bay Area!

Amar REALTOR® offers expert real estate services with proven results in Bay Area Housing Market, including Homes for sale in Santa Clara County, San Mateo County, Contra Costa County, and Alameda County.

More Interesting Information about Bay-Area Real Estate

Record high: U.S. homeowners have over $27 trillion in home equity

Google Village in Bay Area: What You Need to Know?

The Difference Between Federal Funds Rate and Mortgage Interest Rate

How the Federal Reserve Affects Mortgage Interest Rates

How to Get Ready to Purchase a Home: Tips From a Mortgage Loan Officer

Source URL: https://www.amarrealtor.com/real-estate-news/history-of-mortgage-rates-what-does-it-mean-for-home-buyers/